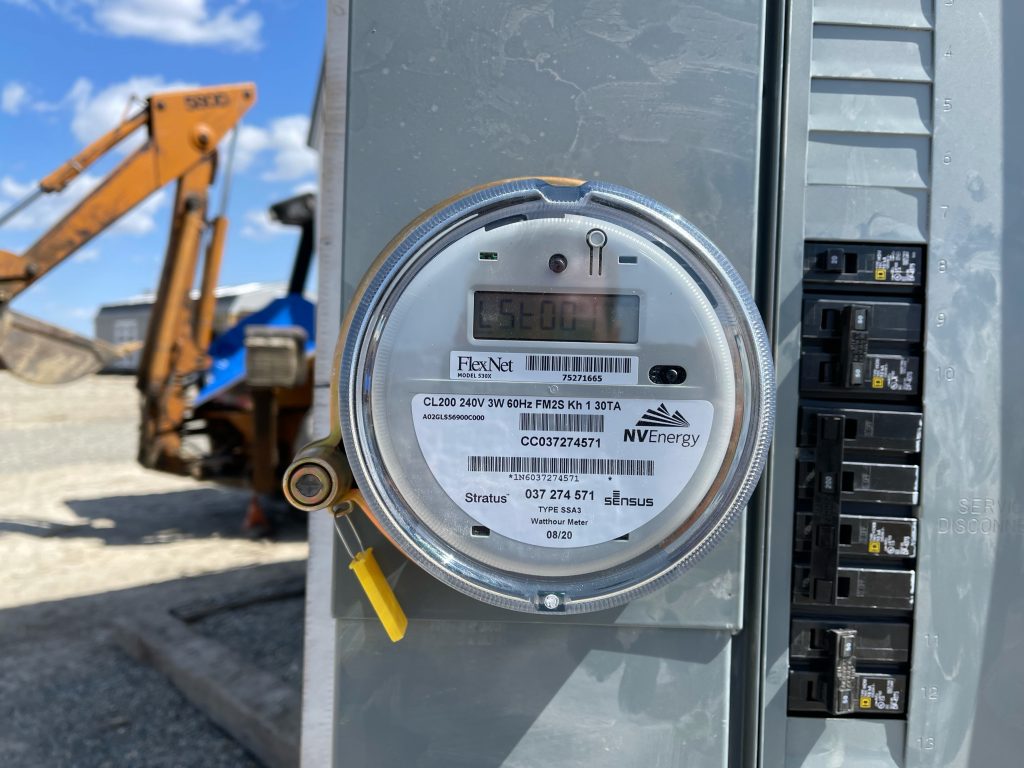

I live in unincorporated Pershing County Nevada, there are less than a thousand people in my part of the county. The closest town is one county over, about ten miles from my house, and has a population of just over eight thousand people. Over the last two years my husband and I have noticed an increase in businesses closing or relocating. The one barber shop in town specializing in men’s haircuts closed because the old dude who cut hair died on a fishing trip. The Chrysler, Dodge, RAM dealership closed because the shop manager had a heart attack on the toilet, coupled with the owner doing questionable accounting practices – without the shop bringing in real income the business failed. The Pizza Hut in town was there one day, the next day it was closed, and a month later the building was gone. A furniture store we would drive by every time we went into town moved to a smaller location. The largest HVAC company in town also moved to a smaller location. A tire repair shop that had been in the same location since Jesus wore sandals closed due to the owners not wanting to deal with a bomb threat and an actual bomb found on their property. All of this in the last year or so…Next month, the one package receiving location – think UPS Store that is not a UPS Store – is closing shop. There is no longer a FedEx depot in town and the UPS location has no customer facing storefront (they had one that was open for exactly one hour a day two years ago, but it closed).

But there is more. Businesses are not open as they were in the past. The BBQ joint that was open six days a week when we moved to town (closed on Sundays) is now only open on five days a week and reduced hours three of those days. The restaurant in one of the three casinos in town used to be open seven days a week is now only open five, and only for dinner on two of those five days. One of the other two casinos has had their restaurant closed since last December for repair/remodel – they were scheduled to open for Valentine’s Day, they did not. The chicken wing bar on the eastern side of town which was open until one AM when we used to stay at the adjoining RV Park, is only open six days a week and doesn’t open until noon on Sundays, closes at ten during the week and eleven on weekends. The three grocery stores are on reduced hours, the twenty-four-hour Walmart isn’t, and the three fast food places along the truck stop are reduced hours. The once multi-location U-Haul shop is a shell of its former glory and everywhere you look self-storage facilities are going up.

The town lost about ten percent of its population since the start of the pandemic and I’m sure we will learn it’s more than that during the next census. I will not say that the town is slowly dying, but it sure looks like the town is shrinking. And that’s not why I’m writing today. The main reason I pulled out the computer to type was a thought that has been going through my head for the last few weeks. Local journalism is dead.

Remember that tire repair shop in the first paragraph? The one with the live bomb found in their facility. Yeah – that’s what got me writing. You see, there was no news coverage of the story. There are no articles that I can link you to definitively stating that the owners closed shop because of a bomb found in their store. Sure, if you check the local police blotter for the right night you can confirm what the locals at the bar told you the night before, but you have to do the leg work. Let me set the stage…

My spouse and I were sitting at the casino enjoying a beer catching up with the staff and regulars. We had been out of town for three months avoiding the coldest part of winter. The kitchen was still closed (it closed before we left). The bartender who had said the night we were leaving was to be her last night was still there and the regular bar flies were enjoying their regular drinks.

As the night wore on the subject of employment came up and my husband remarked that the tire store was always hiring and that the person he was chatting with could always go work there. Everyone behind the bar and the rest of the people in the room all went white and we were informed that the tire shop had closed while we were gone. One of the staff told us about the bomb threat and that the bomb was found and exploded safely by the SWAT team in the large parking lot next door.

None of this was in any of the local or regional newspapers. In fact, as far as I know, my account of the story is the only telling on the internet.

We don’t have local news. You have a business that is issued a bomb threat and it’s found to be true, and the bomb located and exploded, and there is no news story? What gives? I’m working on confirming what I was told at the bar with my local sheriff’s deputy who happens to be on the SWAT team. Based on what he tells me, I’ll update this article.

Someone who commits a crime in Reno, two and a half hours away and flees to my town and is caught makes the news, but a tire store that has been in town since the dawn of time closes due to a bomb gets no mention.

When I worked in Watertown, Massachusetts my employer’s office was bombed, except the bomber didn’t know that we had moved up one floor and tossed his bomb into someone else’s laboratory. It was a stem cell research lab . The local news (this was 2004 when we still had local news) was there and, incorrectly, assumed the bomb had something to do with stem cell research. But they dug deeper and found the bomber to be the same person who tried to burn down my employer’s lab three years prior. They learned that he had just gotten out of prison for the fire weeks before he tossed the bomb… Where is that kind of reporting for the tire shop?

The tire shop that installed the tires on my backhoe…

The tire shop that installed the tires on my Airstream…

The tire shop that installed the tires on my trucks…

The tire shop that my neighbor recommended I do business with…

My tire shop.

Where is reporting on what happened to my tire shop?

EDIT: A few days after typing this post I learned that one of two water well drilling companies went out of business as the owner, 85 years old and working every day, passed away back in December. So yeah, the shrink continues.